With car insurance, like comedy, it seems timing is everything.

A recent investigation by Money Saving Expert has revealed that buying your car insurance three weeks ahead of the start day is likely to get you the cheapest price from a comparison site, even cutting the cost of your premium by an incredible 50%.

After analysing 18 million+ quotes from January to May (From various insurance comparison sites) the investigation discovered a huge price variation depending on when you get your car insurance policy.

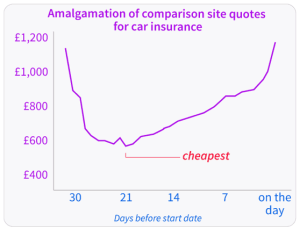

The optimum time is 21 days before the new policy starts (which will be at renewal for most). Too early or too late and the price shoots up, as this graph shows from Money Saving Expert. In fact, a typical policy would cost an average of £1,156 on renewal day, but £589 three weeks earlier.

Money Saving Expert challenged insurers about this. LV openly told them:

“One factor is the gap between the date the quote is requested and the renewal date. Our historic claims data shows riskier drivers renew their policies nearer to renewal.”

Money Saving Expert founder Martin Lewis said:

“Car insurance pricing is based on a mix of ‘actuarial risk’ and which section of the market is targeted. To find the risk they look for patterns, and we’ve uncovered that one of those is how early you get a quote before renewal. To avoid being a last-minute loser, everyone with car insurance should, at the very least, put a note in their diary 25 days before renewal to sort it within a week.”

So, moral of the story? Don’t leave anything until the last minute. Especially your car insurance. By getting in early, you could be pocketing £550+ per year in savings. Don’t delay and secure your best possible price today!

If you’d like to find out more about our Car Insurance options here at Omni Davis, please get in touch by giving us a call on 01403 785775 | 01243 864018 or sending us an email at info@omnidavis.co.uk.